What we’ll cover:

- How to get started

- Model fund portfolios to suit different risk appetites

We understand that getting started in the first place is possibly the biggest hurdle to overcome. You may well have opened your investment ISA or a SIPP but unless you have an informed view about the specific investments to buy it can feel like guesswork due to the vast amount of choice (this was how it felt to us when we were getting started).

We at Howtostartinvesting.co.uk think simple is good. We have developed some example portfolios that you could use to get yourself off the starting blocks. Each is aligned to a different risk appetite. All the way from lower risk, to being comfortable with higher risk. None of them are prescriptive; you could combine some of the features from the Lower and Medium risk portfolios for example, or you could rework the allocation weightings completely yourself to develop something that makes you comfortable. They are just guidance that could help you get started.

Don’t forget that your attitude to risk will depend on how comfortable you are with volatility, and whether you are seeking high long term returns at the expense of potentially loosing money. Always remember that regardless of the risk level assigned to each of these portfolios they could all loose value in the short and longer term. As an investor you must be conscious of this.

But, the most basic way to managing your risk exposure is by deciding how much to invest in the first place!

REMEMBER: each portfolio assumes that you already have set aside your emergency fund of easily accessible cash.

Funds vs Stocks in Individual Companies

Each of the model portfolios below are based around a core holding of funds, with the Medium and Lower risk portfolios comprised entirely of funds.

What are stocks in individual companies? Publicly listed companies enable anybody to own a part of the company, from individuals like us, to large pension funds. Each part of ownership is called a share (or stock), and collectively the shareholders own the company. Any profits the company makes can be returned to shareholders as dividends and as the value of the company rises and falls the value of the individual shares rises and falls.

What is a fund? A fund is a grouping of lots of individual investments in stocks of individual companies. The performance of all the stocks are collectively measured to give the overall performance of the fund. Investors like you and I can buy a small piece of the overall fund (units of the fund), and our investment’s performance matches that of the fund. The fund is usually set up with a specific theme, for example to track the performance of UK companies, or to invest in technology companies.

Model Portfolios

Our model portfolios aim to get you started by taking some of the complexity out of building your portfolio and tailoring it to your risk appetite. Whilst we love investing in individual companies, funds are a great way to start as they are so simple to buy through regular monthly contributions.

The following is how you can build a portfolio from funds, cash and individual companies (optional).

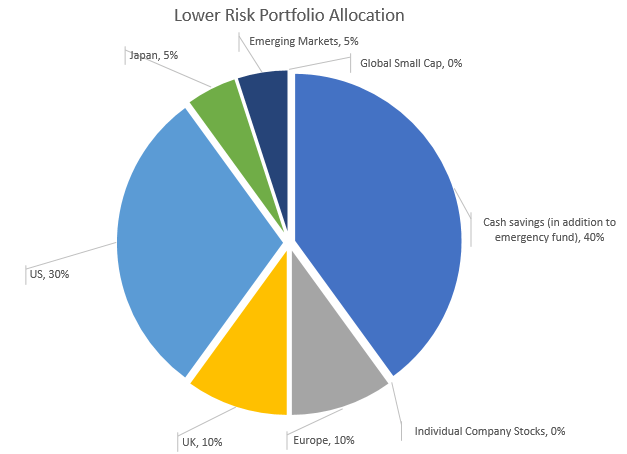

The Lower Risk Portfolio

The Lower Risk Portfolio is a mix of funds and cash (with a sizable proportion to be held as cash). The proportion of cash in the pie chart is shown as 40% but you can decide whether to increase or decrease the proportion, and you might change this over time as you build confidence.

Because of the proportion of cash, this portfolio is likely to perform worse than (underperform) global stock markets over the longer term, as the cash allocation is unlikely to grow in value. However, for investors with a lower risk appetite the cash is likely to act as a useful way of taking out some of the volatility from the portfolio (i.e. when markets fall in value, the lower risk portfolio will be moderately cushioned from this).

The Medium Risk Portfolio

The Medium Risk Portfolio includes for no cash holdings (in addition to an emergency fund). The portfolio is broadly aligned to the weighting of each geographic area in relation to the global market, so the overall performance of this portfolio should reflect the performance of the global stock market. This provides a healthy amount of diversification that we think is important to avoid potential troubles that a particular country can run into.

Building the Medium Risk Portfolio entirely out of funds gives the greatest opportunity for achieving those historic average returns of 7% – 10% for the UK and US markets. The portfolio allocations aligned to each geographic area gives diversification through the size and types of company that are most prevalent in each market.

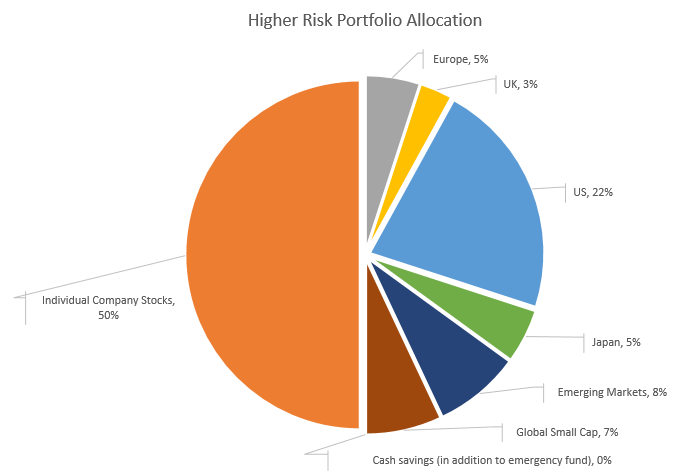

The Higher Risk Portfolio

The Higher Risk Portfolio includes a shift from investing entirely in funds to balancing the portfolio between funds and individual stocks. Including individual stocks gives the opportunity for higher returns that exceed the performance of the global market, but this also introduces a greater degree of risk and volatility. The 50% allocation to funds cushions some of the volatility and risk exposure that would otherwise be present if the portfolio was comprised entirely of stocks in individual companies.

Within the fund allocation there is also a greater allocation to emerging market and global small cap funds. Both of these themes generally come with higher volatility in the shorter term but improved scope for stronger performance in the longer term.

That’s useful, but which are the specific funds I could buy?

(Good question, that’s why we asked it).

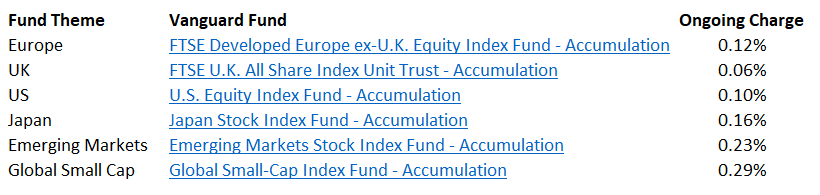

Below is our suggestion for a fund aligned to each of the geographic areas shown in the above model portfolios. Each fund is:

- Passive – meaning it matches the average performance of a (usually) high number of company stocks that the fund owns. The make up of the fund is (usually) automated to reflect the relative sizes of the companies in each geographic area. This is as opposed to an ‘active’ fund, where a fund manager is actively buying and selling company stocks to try to maximise the performance of the fund.

- Cheap! – the ongoing charge that you pay for holding each of these funds is low. Passive funds are generally far lower cost than active funds.

- Vanguard funds – Vanguard is the fund provider. They specialise in low cost, passive funds and have done so for years. (Note that we at Howtostartinvesting.co.uk receive no royalties or other forms of payment for suggesting Vanguard funds. We just think they are great!).

To read more about the individual funds above, you can find them on Vanguard’s website, here.

These funds are a simple and easy way to help you get started, but there is a whole raft of options to chose from once you gain some experience and confidence. You could well stick with the above list for the rest of your investment time horizon, but you don’t have to. Just make sure you are considering how any funds you select could affect the potential risk of your overall portfolio and that you are comfortable with it.

Remember that whilst we think these funds would make a well structured portfolio it doesn’t mean they are right for you in your particular personal and financial circumstances. It’s important to do your own research and if in doubt speak to a financial advisor.

What we do:

We have a investment portfolio similar to the Higher Risk Portfolio, which includes a mix of individual stocks and funds. We have both funds and stocks that we hold with several companies (not just Vanguard), which each has its own pros and cons. Some examples are Fidelity, eToro, Hargreaves Lansdown and IG.

Concluding Points:

Getting started isn’t as difficult as you might think. You just need to:

- Pick a fund provider (E.g. Vanguard)

- Open an account (e.g. an ISA)

- Pick funds that would create a portfolio that suits your risk appetite

- Set up regular monthly contributions

Get a head start in the stock market. We put our money where our mouth is

Howtostartinvesting.co.uk

We would love to hear from you.

If you would like to:

- Tell us about your experience of investing

- Give us feedback or suggestions for our website

- Get in touch about anything else

Then contact us

Facebook page (coming soon)