What we’ll cover:

- The longer you stay invested, the higher your chances of success.

If you have gotten this far you:

- Have learnt (or already knew) that investing in the stock market is much more likely to grow your money than by leaving it in a savings account.

- You understand that some people will have misconceptions about how risky investing money into the stock market it, but statistically over the long term, they have always been proven wrong.

- Appreciate whether or not you have enough spare money at the end of each month to start investing in the stock market.

Now we need to learn about whether investing could be right for you. Its as simple as this…

- If you are ok investing your money and leaving it there for 5 years or more, then yes investing should be a really good decision.

- If you are able to invest for more than 10 years, then its definitely the right move.

- If you are in your 20’s or 30’s and wanting to save money to retire early, then absolutely!

- However if you are saving your money for the following reasons, then stay clear. Put your money into a bank account:

- Buying your partner a bike for their birthday

- Fund a holiday to Peru in 2 years

- Put down a deposit on your first house in 3 years

Why?

Its all about your investment time horizon. In Step 1 of the Investment Pathway we talked about some of the biggest market falls over the last century. Your number 1 goal of being invested in the stock market is to not sell your investments when the market is at a low point and they are worth the least. The best way to achieve this? (Its pretty simple). Make sure you don’t have to sell at a low point. The only things that could force you to sell your investments at a low point, are:

- You have lost your job and can’t afford to pay your bills without selling some of your investments. (Hopefully though you still wouldn’t need to sell all your investments because of the emergency fund you built up as per Step 2).

- You were investing in the stock market for some short-term savings goal (like funding your wedding; unless you and your fiancé are happy to be engaged for 5+ years, your time horizon is probably too short for investing).

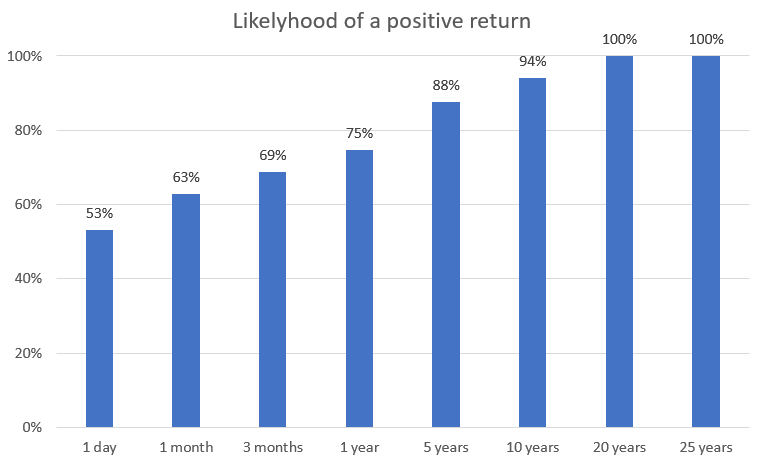

Time horizon is so important because of simple statistics that we all learnt in school (then forgot shortly after). Statistically, over 5 years or more the stock market will increase in value. The higher the number of years, the greater the likelihood that it will have gone up. Over fewer numbers of years, the stats aren’t such a sure thing. Over a year or less, you might as well toss a coin to guess whether the stock market will go up or down.

The beauty of being equipped with this knowledge is that if you are investing for the long term, you can buy stocks then just sit back, relax and watch all the ups and downs without having to worry about it.

Put your feet up.

So, figure out what you are investing for if you don’t know already. As long as you are sure that you don’t need to access the money in the short-term, investing the money for long-term returns is more than sensible.

Concluding Points:

- Historically stock markets have delivered positive returns over long timescales, likelihood improves with longer timescales of staying invested.

Get a head start in the stock market. We put our money where our mouth is

Howtostartinvesting.co.uk

We would love to hear from you.

If you would like to:

- Tell us about your experience of investing

- Give us feedback or suggestions for our website

- Get in touch about anything else

Then contact us

Facebook page (coming soon)