What we’ll cover:

- Putting money into a savings account actually makes you poorer over time.

- Long-term investing beats long-term saving. Always.

- Investing in the stock market is low-risk if done properly.

You are here because you are fed up earning a pathetic interest rate on your savings and you want to find out how investing in the stock market could help you grow your hard-earned money. We hope the following steps will help!

Hang on though, isn’t it sensible putting money in a savings account? Surely that’s the sure-fire way to get rich?

Wrong!

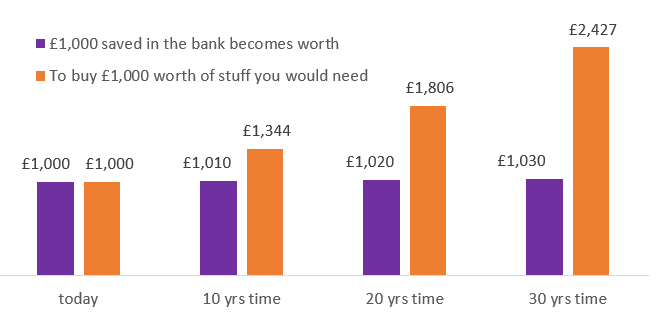

Savings accounts pay interest, and interest puts money in your pocket. That’s good (obviously) but only if the rate of interest exceeds the rate of inflation. Inflation is the rising cost of living (e.g. the price of food and clothes creeping upwards each year). If inflation is higher than the rate of interest you get on your savings, then you will actually be getting poorer the longer your savings sit in your bank account. That’s bad. We don’t like poorer. [Effectively your money is worth a lower amount, because the same amount of money can buy less stuff. 20 years ago you could buy a Mars bar for 30p, now that same 30p couldn’t even buy half a Mars bar].

Check out the above chart. It shows that for every £1,000 you have today getting zero interest in a savings account, it will effectively be worth as little as £544 in 20 years time! Ouch! And that’s based on a relatively modest assumption of 3% inflation!

“Rule number One is never lose money. Rule number Two is never forget rule number One”

Warren Buffet

It is often the case that the rate of inflation is higher than the interest rate that banks will pay you on your balance. If your financial goals include being poorer in the future than you are now, then putting all your money in a savings account and leaving it there for the long term is a great way to make your dreams come true. If however, like us, your goals are to get richer in the future, then savings accounts are not the answer.

This second chart shows the difference to your buying power that keeping money in a savings account could make if interest rates are low and inflation is averaging 3% per year.

What we are getting at is that putting all your hard-earned cash into savings accounts is practically guaranteed to make you poorer over time. The reason why many people don’t fully appreciate this is because your account balance doesn’t actually decrease (you still get paid some interest), it’s just that due to inflation your account balance will be worth less (compared to the stuff you buy) than it is today.

The banks know this, and they have to be pretty transparent about how much interest you will receive over time. It’s good that they are honest. They provide illustrations like this:

Missy Elliott deposits £10,000 into her savings account. She receives an interest rate of 0.1%. After 5 years, her balance increases to £10,050 and 10 pence.

That’s a total return of a smidge over 5% over 5 years (banks probably wouldn’t use the word ‘smidge’, admittedly).

That means Missy Elliott is rewarded with a pathetic £50.10 for stashing way 10 grand and not touching it for 5 years. That amount of money would struggle to buy her a new pair of trainers, and that’s all the reward she gets for keeping £10k in lockdown for 5 years! Seems crazy to us.

Banks actually profit from the more money you save with them. They don’t lock up your money in a huge vault somewhere, they use your deposits to invest in companies, or make loans to other people and companies. In doing this they receive far more interest on your money than they are giving you and can therefore grow the value of that £10k much better than us savers could.

We are not completely against saving money in the bank though. Its really important to keep an emergency fund that would see you through hard times, for example if you were between jobs or you were too ill for work for a while. More on this in Step 2.

So, what’s the answer?

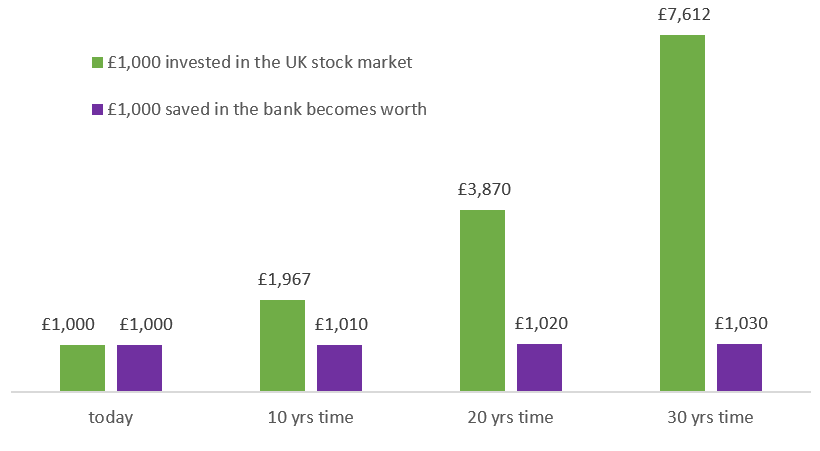

Just like we know that interest rates on savings accounts often can’t compete with inflation, similarly the average returns from investing in the stock market far exceed the rate of inflation. In the UK, the long-term average return from the stock market has been 6-8% and in the US it has been higher at around 10%. These are big numbers compared with the interest rates that banks are offering (around 0.1% at the time of writing this). Astonishingly, over the last 10 years, the value of the 500 largest companies in the US would have turned your £10,000 into about £28,000! That profit of £18k could buy Missy Elliott loads of trainers!

Let the above chart sink in for a moment. The green bar is what people invested in the stock market have been experiencing over the long term. The purple bar is what might happen to your money in the bank if interest rates continue to be super low.

But there’s got to be some downside, right… so what are the risks?

People that don’t have much experience in the stock market might make the argument that “the stock market could crash and you could lose everything.” This is an unhelpful irrational fear for several reasons, but it is a really good reason to never invest in the stock market – and leave making a handsome profit to other people…

Just to dispel any fears:

- Those previous figures of between 7 and 10% returns over the long term take into account every bad day, week, year and decade the stock market has ever had. If an investor was able to just sit tight through the good days and bad days they would have still made 7%- 10% returns. This includes all the famous bad periods of the stock market: the great depression in the 1930’s, the slump after WW2, the flash crash in the 1980’s, the aftermath of the dot-com bubble in the early 2000’s, the global financial crisis starting in 2008, and yes even the crash due to Covid 19 in 2020. Every one of these events caused a short term decline in the value of people’s investments, but each time the stock market recovered, and the value peoples’ investments continued onwards and upwards.

- For most investors in the stock market, time is your biggest weapon. This is because of the magic of compound returns working for you. More on this below.

- Can you lose everything? Never in the history of mankind has the value of the whole stock market suddenly gone down to zero. It is possible for an individual company to collapse and cease to exist though. However, sensible investors wouldn’t put all their money in a single company. They would spread it out across a few companies, or even all companies publicly trading in different markets or countries. This is called diversification – not putting all your eggs in one basket. So long as you are not doing something really stupid (like borrowing a lot of money to invest with and not diversifying your investments) its practically impossible to ‘lose everything’. Some of the biggest stock market drops in history have bottomed out at around -40% from their all time high, but as per point two above, they have always gone on to increase to even more than before the drop.

The main thing that investors should fear is fear itself. When things get uncertain and prices start falling, investors can get tempted to sell everything for a loss. If they were able to ignore the day to day changes in prices and remember the three points above, they would be on to a winner.

Compound Returns

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it”

Albert Einstein

We looked at the returns of the largest US companies over the last 10 years. We said that it averaged 10.85% per year, and 281% over 10 years. At first glance, this might not make sense. 10 years of 10.85% interest would make a 108.5% return over ten years surely?

Nope.

This is the magic of compound returns. Let’s have a look at Missy Elliott’s £10k example again:

This time Missy invested her £10k into the stock market in January 2010, with an average annual return = 10.85%

| Year | Start balance | Avg growth rate | Investment growth | End balance |

| 1 | £10,000 | 10.85% | £1,085 | £11,085 |

| 2 | £11,085 | 10.85% | £1,203 | £12,288 |

| 3 | £12,288 | 10.85% | £1,333 | £13,621 |

| 4 | £13,621 | 10.85% | £1,478 | £15,099 |

| 5 | £15,099 | 10.85% | £1,638 | £16,737 |

| 6 | £16,737 | 10.85% | £1,816 | £18,553 |

| 7 | £18,553 | 10.85% | £2,013 | £20,566 |

| 8 | £20,566 | 10.85% | £2,231 | £22,797 |

| 9 | £22,797 | 10.85% | £2,474 | £25,271 |

| 10 | £25,271 | 10.85% | £2,742 | £28,013 |

You can see that each year, the amount of growth increases by a larger and larger amount (£1,010 in the first year, and £2,742 in the 10th year). This is with no further investment, just using the initial £10k. This is because in each subsequent year you receive growth on your original £10k plus on all of the previous years’ growth.

This is why it can be so beneficial to start investing as soon as possible. The table goes on and on and the figures get bigger. So, if we assume the same 10.85% average return rate would continue: if you invested that £10k when you are 40 years old, by the time you are 50 you would have £28k. But if you started with that same £10k when you were 30 years old, by the age of 50 you would have £78k! Compound returns have just turned £10k into a brand new Porsche 911.

This is the power and importance of compound growth on your investments.

Concluding points:

- Inflation will eat away at the value of your savings

- Keeping money in a savings account is a sure-fire way to make your money less valuable in the long run

- The stock market has returned >7% per year over the long term, far in excess of any savings accounts with banks (with our Invest Like Us strategy we aim for more than 7% per year)

- The earlier you start investing the more time you have for compound returns to work in your favour

Get a head start in the stock market. We put our money where our mouth is

Howtostartinvesting.co.uk

We would love to hear from you.

If you would like to:

- Tell us about your experience of investing

- Give us feedback or suggestions for our website

- Get in touch about anything else

Then contact us

Facebook page (coming soon)